In our recent articles we’ve been advising our readers and clients to do two things:

- Be cautious investors and do not take on too much risk

- Focus on fixed income and equity funds

We’re not the only ones who have been doing this. Warren Buffett of Berkshire Hathaway seems to agree with our thinking.

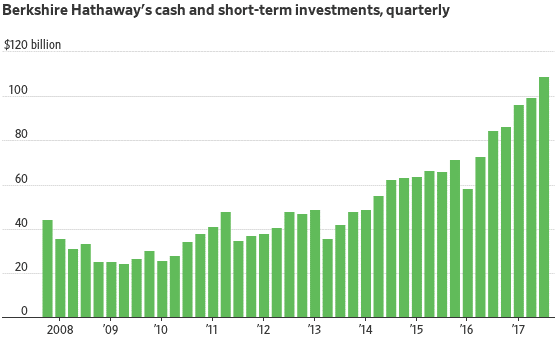

A recent article in the Wall Street Journal notes that the Oracle of Omaha holds over $100 billion in cash, most of which is in short-term Treasury bills.

While T bills don’t currently offer much of a return, Buffett believes they’re the best place to park his growing cash surplus. That’s because it’s becoming increasingly difficult to find anything of value worth buying.

Berkshire Hathaway isn’t the only company that has huge amounts of cash on its balance sheet.

According to Business Insider, here are the top 15 companies with the biggest cash stockpiles in billions of dollars (as of December 2017):

- Apple – $261.5B

- Microsoft – $133B

- Alphabet (Google) – $94.7B

- Cisco – $68B

- Oracle – $66.1B

- General Electric – $44.1B

- Amgen – $39.2B

- Qualcomm – $37.8B

- Gilead Sciences – $36.6B

- Coca-Cola – $27.2B

- Intel – $25.9B

- Merck – $24.1B

- Amazon – $24.1B

- Pfizer – $21.3B

- PepsiCo – $17.2B

Collectively that’s almost one trillion dollars sitting on the sidelines, doing nothing but earning small amounts of short-term interest.

Warren Buffett, Bill Gates, Tim Cook, Jeff Bezos and many others see too much money chasing too few deals.

They’ve decided to sit on the sidelines for now, playing it safe with conservative investments.

We advise our readers and clients to do the same.