Last month, we wrote about the negative impact that China is making on the US real estate market.

Between 2005 and 2017 the Chinese placed nearly $1 trillion in foreign investments. So far this year they’ve invested just $6 billion.

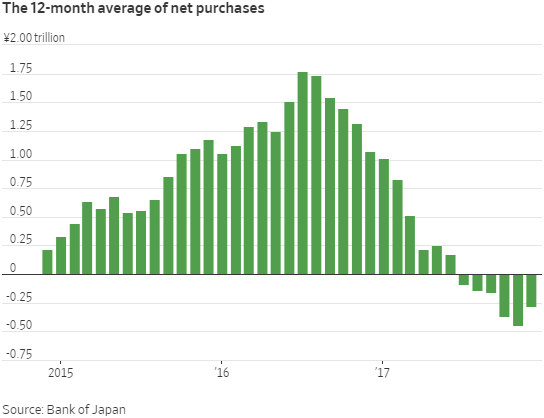

Now it appears the same reduction in investments is occurring in the bond market. Not just with China, but with Japan and the US Federal Reserve as well.

A variety of publications such as the Wall Street Journal, Bloomberg, the Financial Times, and Reuters have all recently reported that both China and Japan are ‘re-thinking’ their U.S. Treasury holdings.

China and Japan reportedly have a combined total of nearly $2.3 trillion in US bond holdings.

Depending on who you believe, these countries are either slowing or stopping or selling their U.S. Treasury purchases.

This is happening at the same time that the Fed has begun to unwind their bond holdings accumulated over the past several years.

Pundits will argue that there’s no way China and Japan will stop buying and start selling U.S. Treasuries. That’s because doing so would hurt the value of their existing holdings and play havoc with the global economy.

Maybe yes, maybe no.

But when one looks at the quick and dramatic reduction of China’s foreign real estate investments, it’s not difficult to believe that something similar could occur in the bond market.

Remember, there’s an inverse relationship between bond prices and yields.

As the perceived value of bonds goes down, yields go up in order to attract investors. If there are more sellers than buyers of bonds, interest rates will rise.

In fact, this has already been happening.

Interest rates paid on marketable interest-bearing U.S. Treasury debt (such as bills, notes and bonds) have increased by 7% over the past year – from 1.986% in December 2016 to 2.126% in December 2017.

That’s a pretty significant interest rate increase over a very short period of time.