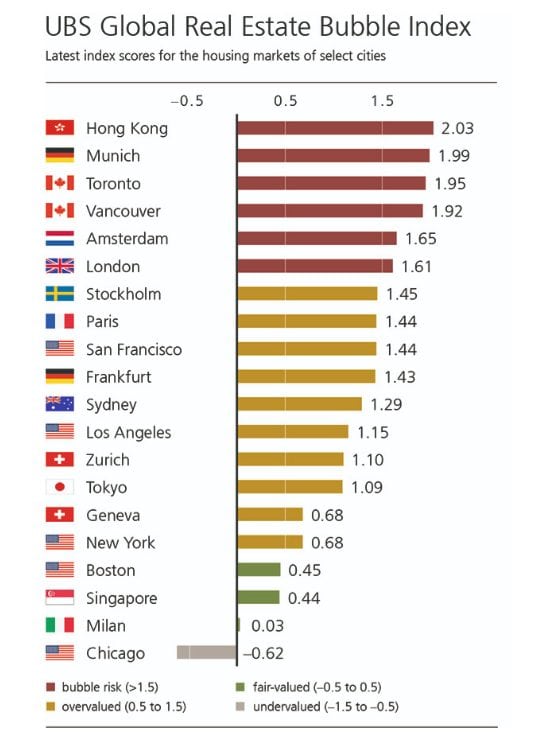

According to a recent report by UBS that looked at the housing markets of selected cities, over the last three years the number of global real estate markets in bubble territory has tripled from just two to six.

Although housing prices in the U.S. continue to soar, no market in the country is yet rated as being at-risk – although some are coming dangerously close.

Factors Inflating the World Housing Bubble

The Global Financial Crisis of 2008 was triggered in large part by the subprime mortgage market in the U.S. which then developed into a global banking crisis. That GFC is also when the housing market in the United States morphed into one single large market.

Before that, markets were fragmented. Individual cities or regional markets became overheated but never before had they acted in unison. Now just 10 years later, it appears that the entire world housing market is beginning to act as one large single market.

The major factors helping to inflate the world housing bubble are:

- Unnaturally low interest rates caused by central bank intervention worldwide

- Assets shifting from stocks into residential rental real estate

- Mobile, liquid capital investing without borders

Top 10 Riskiest and Overvalued Markets

The UBS Global Real Estate Bubble Index cites these 10 markets as being the riskiest or most overvalued:

- Hong Kong

- Munich

- Toronto

- Vancouver

- Amsterdam

- London

- Stockholm

- Paris

- San Francisco

- Frankfurt

Of these top markets, the first six are ranked as being in ‘bubble risk’ territory. In addition to San Francisco, Los Angeles and New York are also ranked by UBS as being overvalued.

Only Four Fair or Undervalued Property Markets

Residential real estate investors with a global outlook have some surprising options both inside and outside of the U.S.

UBS rated four global property markets as being fairly valued or even undervalued:

- Boston

- Singapore

- Milan

- Chicago

Of these four, Chicago was ranked as undervalued, while Milan just barely crossed the line from being undervalued to being fairly valued.

Tighter Government Restrictions

No local government wants the first property bubble to pop in their own backyard. In addition to attempting to reduce risk, local municipalities also want to ensure that their residents have access to affordable housing.

Hong Kong, Toronto, and Vancouver are all implementing targeted taxes or stamp duties to raise the barriers to entry on foreign capital buying local. Switzerland has tightened up regulations on the local mortgage market in an attempt to make financing more difficult to obtain.

Here in California, an initiative to overturn the Costa-Hawkins Rental Housing Act will be on the November 2018 ballot. (See last week’s post.)

If repealed, local municipalities will be able to potentially impose more rent control policies on their housing rental markets. Proponents of overturning the Act believe that more rent control will lead to more affordable housing prices.