Stock market and corporate earnings continue to rise, more and more IPOs are coming to market, unemployment is at record lows, and inflation remains in check. Overall the economy in the U.S. appears to be doing quite well. Except for the housing market, that is.

From a recent article in Bloomberg entitled “The U.S. Housing Market Looks Headed for Its Worst Slowdown in Years”:

“‘This could be the very beginning of a turning point,’ said Robert Shiller, a Nobel Prize-winning economist who is famed for warning of the dot-com and housing bubbles, in an interview. He stressed that he isn’t ready to make that call yet.”

How Bad is the Housing Market?

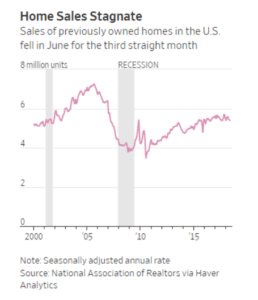

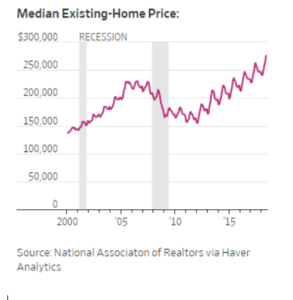

Nationwide the housing market continues to slide as sales in June hit their slowest pace in eight months. At the same time, home price appreciation decelerated in the second quarter of this year to its slowest pace in two years.

- Existing home sales have declined over the last three months

- New home sales have slowed over the past eight months

- Price gains for both new and existing homes continue to slow

Homebuilders Are Hurting Too

Homeowners aren’t the only ones starting to feel the pain from the housing market slowdown. Since the beginning of the year homebuilder stock prices have been flashing red as well.

- The S&P 500 Homebuilders Index is down over 16% from its high the first part of January 2018

- The SPDR S&P Homebuilders ETF – which in addition to homebuilders also includes home-improvement retailers like Home Depot – is down over 15% from its high the beginning of the year

Home Buyers are Disappearing

According to real estate database company Redfin, only 65% of Americans think it’s a good time to buy a home – the lowest percentage since the Global Financial Crisis in 2008.

Home supply has been increasing year over year at home buyers disappear:

- In San Jose inventory was up 12% in June 2018 compared to June 2017

- Seattle inventory rose 24%

- Portland home inventory increased by 32%

Home Prices Continue to Rise More Than Incomes

Home sellers and their real estate agents are nothing if not optimistic.

According to Case Shiller data, home prices in all major metro areas are rising faster than income levels. In 15 of the top 20 housing markets, home prices have increased twice as much as incomes have grown.

But rising inventory levels plus rising home prices equals fewer sales and less motivated buyers.

Until They Don’t

As Ed Stanfield, chief property economist at Capital Economics observes:

People are saying: Let’s just bide our time, there’s no great rush. If we wait six or nine months we’re not going to lose out on getting a foot on the ladder… we’re now looking at a period in which prices move more or less sideways, or increase no more quickly than growth in incomes, over the next few years.

Rising Home Prices Don’t Equal Rising Demand

We’ve written previously about the disconnect between supply and demand in the housing market.

While many real estate experts claim that there’s a lack of supply in the housing market we believe that a long-term structural change is taking place.

Because of this, the single-family housing market will continue to decline, while the demand for senior-focused residential development and assisted living facilities will continue to rise.