With both stock prices and home prices at all-time highs, one would expect the people in charge of our financial system to become more cautious.

Instead, the opposite is occurring.

As the markets continue to hit record highs, banks are being encouraged to do more of the same things that created the last Global Financial Crisis back in 2008.

Federal regulators and Congress have been ignoring the laws that were put in place to help to prevent the same systemic financial problems of just 10 years ago while at the same time overlooking bad banking behavior.

In turn, the Federal Reserve will raise interest rates more aggressively than it has been, which causes bond yields to rise (and bond prices to go down), and the cost of financing to increase.

In turn, the Federal Reserve will raise interest rates more aggressively than it has been, which causes bond yields to rise (and bond prices to go down), and the cost of financing to increase.

Here are two recent examples:

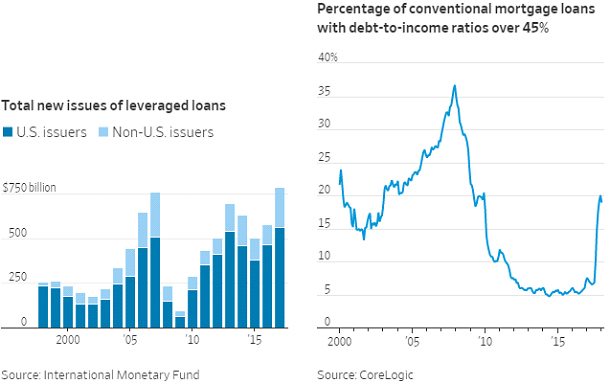

Freddie Mac announced last week that they are introducing a new 3% down payment option conventional mortgage program with no income restrictions and no geographic restrictions. Loan programs such as these helped to cause the housing market to crash just 10 short years ago.

Wells Fargo Bank – the poster child for banking scandals – is being investigated by the US Department of Labor for putting customers into high-fee retirement accounts that were bad for the customer but very profitable for the bank.

This most recent Wells Fargo scandal follows the Bank’s recent car insurance scam where the Bank illegally forced vehicle owners to accept car insurance that they couldn’t pay for, then repossessed their vehicles for their inability to pay. Then there was the 2016 scandal when Wells Fargo employees in California sold customer information to a ring of identity thieves. And the 2016-2017 scandal when the Bank created millions of fake accounts.

We don’t mean to pick on Wells Fargo – but the Bank just doesn’t seem to be able to keep itself out of trouble. Each day, too-big-to-fail banks and financiers around the world are acting more and more as if they’ve never heard of the Global Financial Crisis.