In our April article, Is Conspicuous Construction An Economic Red Flag?, we noted how for the past 700 years the construction of tall office buildings has consistently marked the top of economic cycles.But office building developers are not students of history. They will do whatever they can to make a project profitable – until there’s nothing else that they can do.As office buildings become taller and effective rents are getting squeezed, office building owners in Manhattan have discovered a new way to subsidize declining office rents.

Making Money from Tourists, Not Tenants

An article in the Wall Street Journal last week estimated that the observation decks of Manhattan’s One World Trade Center, 30 Rockefeller Center, and the Empire State Building attract a combined total of more than 9 million visitors each year.

Based on an average admission fee of $30 per person, that translates to $270 million in annual revenue – before concession sales from food, drinks, and souvenirs are factored in.

With just under 8 million square feet of rentable space in these three skyscrapers, that $270 million in revenue each year brings in nearly $34 per square foot of extra gross income. Not bad, considering that the average Class A asking rent for office space in Manhattan is $79 per square foot.

(source)

Effective Rents Are Getting Squeezed

Landlords are welcoming that extra income now more than ever as effective rents are compressing not only in Manhattan, but across all major markets.

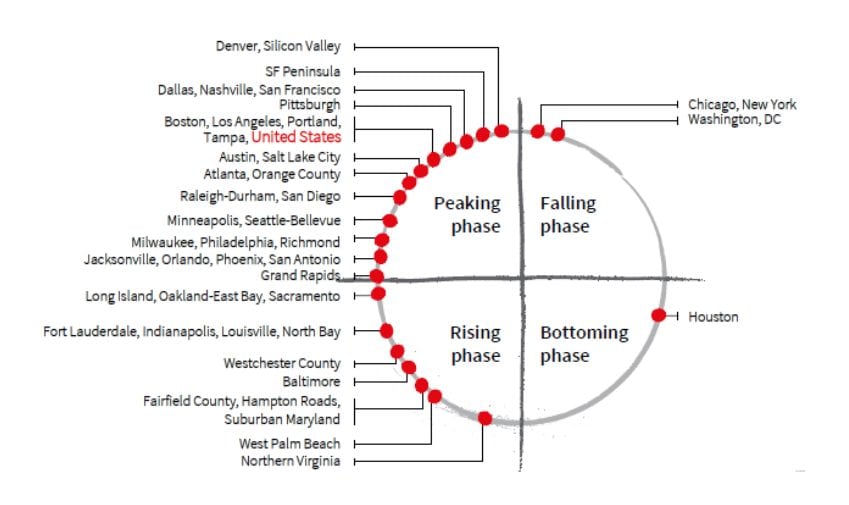

In fact, it looks like the storm is just beginning.

According to the Q2 2018 United States Office Outlook Report by JLL:

- Net absorption of office space is the lowest it’s been since 2010

- Through this year and into 2019 completions will spike sharply

- Vacancy rose to nearly 15% while deliveries increase

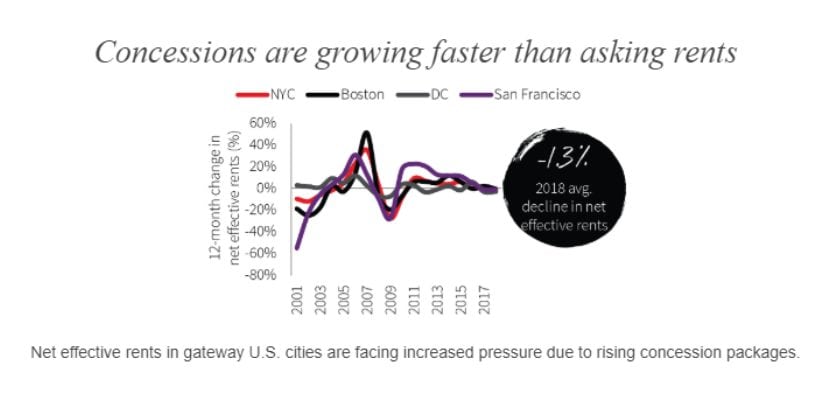

- Rent concessions are growing faster than asking rents

In New York City, Boston, Washington D.C., and San Francisco average effective office rents have actually declined by about 1.3% when rent concessions are taken into consideration.

Calling the Top of The Market

One of the problems with real estate development is that, once it starts, it’s very difficult to stop. That especially holds true of high-rise office building construction.

Going back to Manhattan, two more skyscrapers and observation decks will hit the market in the next two years: 30 Hudson Yards – 1,296 feet tall in 2019, and One Vanderbilt – 1,401 feet in 2020.

With more office space – and observations decks – coming to market, will landlords be able to continue generating enough extra income to offset the decline in effective rents?

Join Our Newsletter!