Since January we’ve been warning our readers and clients that foreign investment in the US is beginning to slow.

But so far this year the amount of money being invested in the United States is less than what even we expected.

Take China, for example.

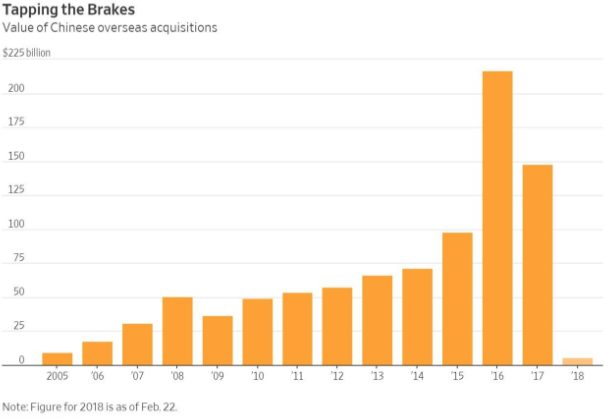

Back in 2005 China placed about $8 billion in overseas investments. Over the years (except for a slight pause in 2009) their foreign investment slowly but surely increased year-over-year.

In 2016 the money invested by China in countries like the U.S. reached a high of nearly $225 billion for that year alone. Just the year before, China purchased New York’s Waldorf Astoria Hotel for almost $2 billion.

Unlike in Western cultures, the number 13 is a sign of luck in China. Except for this time.

That’s because China’s foreign investment so far this year sits at about $5 billion. That paltry amount – at least by Chinese standards – is actually less than is was 13 years ago in 2005.

It’s also barely more than 2% of the total foreign investment China made in 2016. That’s a pretty astounding about-face in a very, very short period of time.

Even though we’re just into the New Year, we suspect that foreign money coming into the US is going to be much less than it has been. And foreign investment has been one of the primary drivers of the commercial real estate market here.

It’s not that real estate in and of itself is a bad investment. As we’ve been writing recently, we’ve simply gotten to the point in this market cycle where there is too much money chasing too few deals.

When that happens, ‘value’ becomes a four letter word. Irrational and inexperienced people buy things simply because everyone else is.

That’s when the smart investors sit on the sidelines and watch the show, parking their money in conservative, short-term liquid investments.

We advise our readers and clients to do the same.